By Nicole Bucka

Author’s note: This editorial is my personal opinion and not a formal communication of the East Greenwich School Committee.

In East Greenwich, we take pride in expecting nothing short of excellence from our schools — champagne taste. We prioritize foreign languages, arts, music, and advanced coursework to ensure our children can compete with their private school counterparts for college spots. As a community, we have set high standards and I was elected to meet those standards. I have dedicated the last two plus years to trying to do so. However, it’s time for a candid conversation about adequately resourcing our schools to maintain the level of excellence we demand.

Public education in East Greenwich relies on funding from federal, state, and local sources. During the 2021-2022 school year, our school district’s operating costs were funded 3.3 percent through federal sources, 11 percent through state sources, and the majority, 87.4 percent, by the local tax appropriation from our town. The reality is that the local community bears the majority of the financial responsibility for our schools by federal and state mandate. The factors contributing to this include East Greenwich’s low poverty rate, coupled with the highest median family income in the state, and elevated property values. These metrics, crucial in the state’s education funding formula, serve as indicators of a community’s capacity to generate revenue through taxes. With East Greenwich boasting a robust median income, it implies we are able to adequately fund our schools. Education grants similarly prioritize communities based on poverty, so funding our schools is our responsibility. Therefore, it’s on us – either balance our expectations with available resources or resource our schools differently. (Editor’s note: you can read about the School Committee’s budget ask for 2024-25 HERE.)

During budget discussions, the town addresses various town department needs, from new rescue trucks to rising personnel costs to inflation. However, the school district, with almost triple the staff of other town departments combined, faces the same challenges and more: unfunded education mandates from the state legislature, contractual obligation increases based on increasing student enrollment, and a perennial lack of resources for facilities across six buildings, professional development, and materials create a constant struggle. The familiar refrain of “needing to keep taxes low” echoes through budget discussions, yet a recent report by RIPEC challenges the narrative that the school appropriation is a key lever for addressing municipal/town tax woes. This is further validated by School Committee member (and Ph.D.) Eugene Quinn’s analysis available on his website demonstrating that our local tax rate swings are a result of the real estate market and property value revaluations (i.e., tax bills). They are not a result of the school district’s budget increases or decreases.

Despite evidence indicating that school costs aren’t the cause of property tax struggles, the district and the School Committee find themselves year-after-year constrained by the prevailing notion of keeping taxes low, hereby known as a beer budget. For the last two budget cycles, the district’s ask has been reduced by half a million dollars each year. This short-term example fits within a longer-term trend of unsustainably-reduced investment in our public schools since 2010, jeopardizing the sustainability of our excellent educational system.

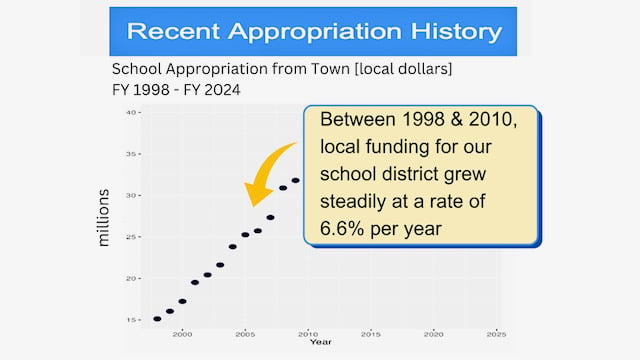

In a School Committee meeting earlier this spring, we discussed a comprehensive analysis spanning 26 years to shed light on our school/district financial situation. Before 2010, our town consistently invested in public education in line with our values (aka champagne taste), with a growth rate of 6.6 percent. [insert png 1]

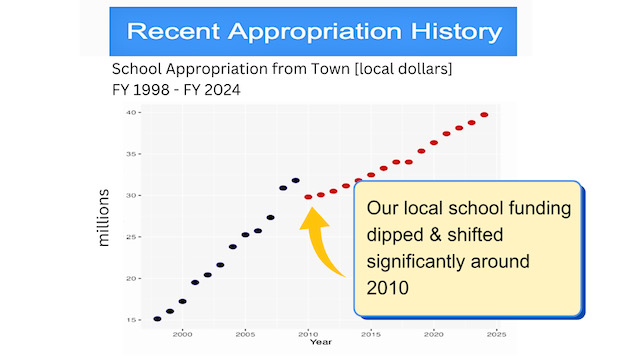

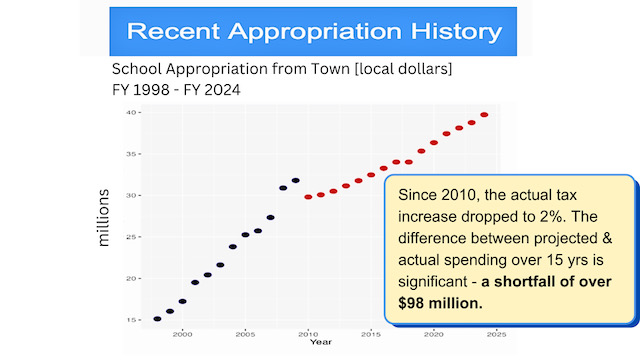

After 2010, though, the school/district appropriation’s growth rate dropped to a consistent growth rate of 2 percent (aka beer budget).

This change created a substantial deficit of $98 million over 15 years. The drastic reduction in funding in 2010 and reduced growth rate following has had a cumulative impact, affecting our ability to address deferred maintenance (remember the high school this winter?) and other crucial needs. [insert png 3] Over time, this forced us to become an exceptionally lean district, managing resources efficiently, but limiting our ability to be invest proactively in essential areas.

Many East Greenwich families, blessed with the resources to choose and valuing education, can opt for private schools when public schools lack investment. This creates a cycle of diminishing support for our public schools, increased costs, and a decline in resources.

As of 2022, our district’s spending per pupil without tuition is the fourth lowest in the state out of thirty-two comprehensive K-12 districts in RI, standing at $18,144 per student. This is in stark contrast to private school tuition, which can be as high as $50,000 per child.

Many people don’t realize that when families opt for private schools, East Greenwich Public Schools may still be funding books, transportation, and special education services for those students (even while we receive $0 federal and state funding for them because they aren’t enrolled). Unless we lose an entire class at a grade level or an entire bus load in a neighborhood to private schools, we can’t reduce buses or teachers . . . our students’ families choosing private schools due to local disinvestment only removes resources, it does not reduce expenditures.

When comparing our public schools to various private options, it’s essential to recognize that private school advantages often stem from having more resources, some of which are derived from the public school system. Every family should do what is right for their child. My only goal is for this community to understand the impact and how it can become a cycle: Community disinvestment, families choose private options further draining resources, leading to further disinvestment.

The state funding formula, covering only around 11 percent of our district’s costs, also lacks any additional funding for students with special needs despite the documented higher costs and extensive legal protections for this population. The state education funding formula, when it was created, used poverty as a proxy for special needs. Due to our low poverty rate, this has produced over a decade of systematic underfunding of students with Individualized Education Programs (IEPs) in our community. While using poverty as a proxy for special needs’ funding underfunded EG, we certainly can’t take that out on our children. We should use our community’s political influence to fix this. Compounding the state’s lack of funding further is the continual churn of well-intentioned but unfunded state legislative mandates, which creates substantial additional fiscal burden. Remember, the state only funds about 11 percent of our district’s operating costs, so these mandated costs end up in the local ask but are not an “ask”…they’re mandated! Again, we need to include these costs in our local funding AND use our political influence to end state legislative unfunded education mandates.

Keep your standards high, East Greenwich residents, and help us reconcile our champagne taste on a beer budget. There has to be a middle ground between 6 percent and 2 percent that we can live with without fueling a cycle of disinvestment. I will work to budget responsibly focusing on internal district efficiencies and you can help ensure that sustainable funding comes in by being a part of a community solution. Worried about taxes? Please thoroughly read the links above. It’s not as simple as reducing the district’s ask each year. Reach out to your representatives and ask for an end to unfunded education mandates and for the state education funding formula to be revised to include guaranteed additional weight/funding for special education.

Together, we can ensure excellence in education for generations to come.

Nicole Bucka is a member of the East Greenwich School Committee.

Subscribe

Subscribe

I hadn’t previously looked at the spend per pupil data from RIDE. They have data that even normalizes for capital spend etc. Ms. Bucka rightly points out that we are spending less than many of our peer towns yet we expect to have a better school system with better results.

Our taxes are very high compared to other towns, but this indicates pretty clearly that the school system isn’t driving our above average taxes.

I’d love it if our town council could provide our spend per resident for our key services compared with similar figures from other similar towns in RI.

The stage 2 application that EG just submitted to RIDE for the upcoming school construction projects includes $13M in field work at Frenchtown alone. If you instead focus the construction on the field immediately behind the existing building, you may be able to save the back two fields, which are in excellent overall condition. Whatever portion of that $13M you could save, it sounds like it would be better spent on educational priorities.