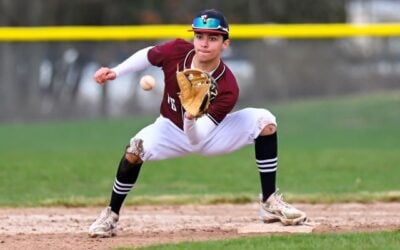

R.I. Education Commissioner Deborah Gist, EGHS Senior Charlotte Palmer and economics professor Margaret Brooks after Palmer presented her findings on the importance of financial literacy to the state Council for Elementary and Secondary Education. Photo credit: RI JumpStart

In high school, students learn a lot of things – math equations, science principles, foreign languages, world history, how to write, how to read. But one area that gets little attention is financial literacy – learning how to manage your money, even as credit card debt and college loans can set young people back financially for years, even decades.

A few students at East Greenwich High School got together last year to change that and not just at EGHS but across the state. Senior Charlotte Palmer was one of those students and recently she spoke to the state Council for Elementary and Secondary Education about why Rhode Island should establish financial literacy standards.

Now, partially due to Palmer’s work, Rhode Island is one of only four states in the nation that has adopted financial education standards.

Palmer is a member of RealEdRI, a group founded during last year’s Choose2Matter event at East Greenwich High School.

“We’re trying to promote financial literacy education across Rhode Island,” Palmer said last week. The group conducted a survey of students around the state to see how much they knew about personal finance. The results prompted them to pursue better financial education standards.

“The first step was to take the two national sets of personal finance education standards, the Council for Economic Education standards and those written by the National Jump$tart Coalition, and decide which one should be recommended,” Palmer said.

She read through each set of standards over the summer before presenting to the Board of Education. She spent over 80 hours researching, reading and meeting with leaders in the field. Patricia Page, the business teacher at EGHS and the 2014 Rhode Island Teacher of the Year, and Dr. Margaret Brooks, an economics professor at Bridgewater State University and president of the Rhode Island Jump$tart Coalition, were her closest advisors throughout this process.

The culmination of her research efforts was her presentation to the council. Commissioner Deborah Gist described Charlotte’s presentation as “fabulous and persuasive.”

On November 10, the Council for Elementary and Secondary Education unanimously voted to adopt the standards that Palmer and the rest of the RealEdRI team had selected, which were those set forth by the Council for Economic Education.

“Rhode Island education is going to start involving more financial literacy,” she said with a smile. “This is the first step in a process, but, it’s a really big step.”

The next step is the inaugural Financial Capability Conference this Saturday, Dec. 6, from 8 a.m. to 3:30 p.m. at Rhode Island College. Commissioner Gist, Senator Jack Reed, and of course, Charlotte Palmer, will attend. The conference will include workshops, free professional development for teachers, and informative exhibits and panels. Anyone is welcome to attend.

Catherine Streich, a senior at East Greenwich High School, is a reporter for East Greenwich News.

Sign up for the EG News newsletter here. You can like us on Facebook here, or follow us on Twitter (@egreenwichnews) here.

And, if you like what you’re reading, consider supporting East Greenwich News by clicking here.

Subscribe

Subscribe

Fantastic efforts and results!

Kudos to Charlotte for leading the way on this. I work in the financial services industry and see first-hand how many people–regardless of education level–simply do not have basic financial skills, so this is just great news. I am curious, though– what does this mean that “Rhode Island education is going to start involving more financial literacy”? How will this weave into the curriculum? Thank you!